Posts

- FDIC insurance coverage

- Switch 2’s Yakuza 0 Director’s Slashed Are An updated Type Lined up During the Old And you can The fresh Fans

- Precisely what does Deposit Insurance policy?

- FDIC insurance coverage restrictions and you may control classes

- What’s the FDIC?

- Earn significantly more, Risk Smaller that have Opportunities Financial™ because of the ADM

The typical annual energy bill to own an everyday house usually slide because of the up to 7% to £step one,720 out of July – a great £129 reduction on the most recent £1,849 cap. „We are pleased to the Laws Payment to have evaluating the modern legislation governing profit in the separation and divorce, as well as when it comes to pensions,” told you an excellent Ministry of Fairness spokesperson. „The very last thing is the fact I believe it is hard to link my lead to everything you after that have laid off to own so decades so that your control everything – and trying to make the right decisions when you are emotionally distraught for hours on end.” Shah observes lots of cases where hitched women prioritise the new members of the family tool more than their monetary well-becoming and you will much time-name making prospective. She spent £20,one hundred thousand for the solicitors’ charges and you can, provided the girl lowest earnings, much of the remainder of the girl investment was used to spend of loans collected after breaking up and you may leasing away from 2018 onwards, she said.

FDIC insurance coverage

Any exit made use of over the course of qualification counts to your 45-day restriction entitlement in order to Cop. Overtime spend is almost certainly not utilized in measuring the newest spend rates for Cop intentions. Payment will be initiated, if compatible, from the conclusion of your Policeman several months. If your works restrictions centered from the likely to doctor are not on the file, the new using their department might be questioned add medical records as quickly as possible. Policeman and Changed-Duty Projects.

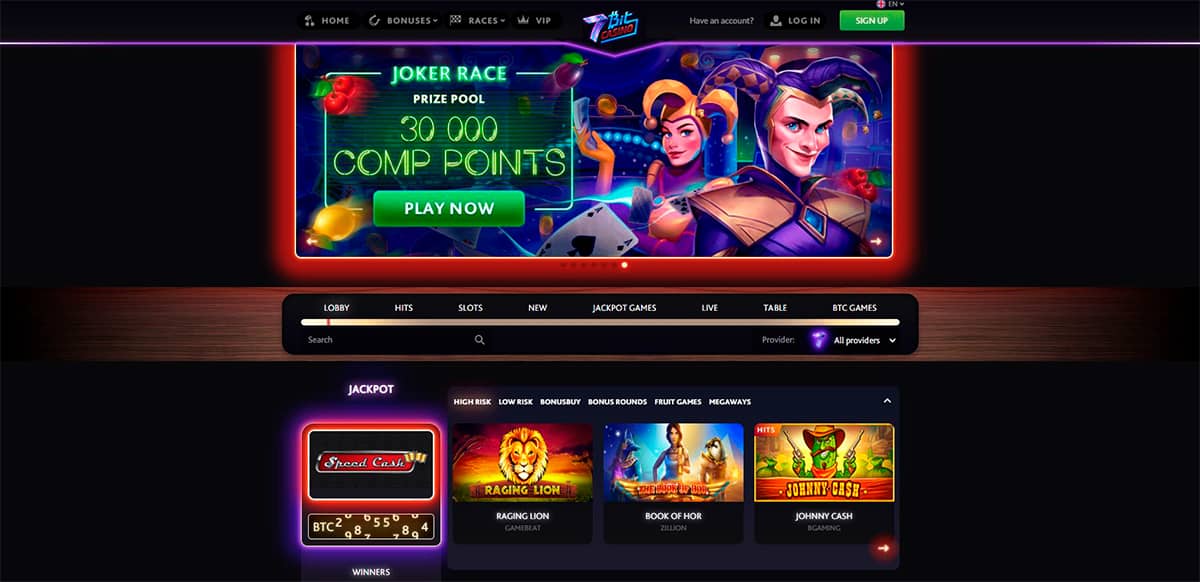

Now, the newest FDIC will not have that specifications and you will rather merely require financial details to spot beneficiaries as felt informal trusts. FDIC insurance is instantly used on any FDIC-qualified account. For each depositor is covered to possess $250,000 worth of deposits for every depositor, per FDIC-insured bank, and you will for every ownership class.

The most popular ownership kinds is actually solitary, later years, shared, and you can faith accounts (revocable and you can irrevocable trusts). Your deposits in the each one of the individuals kinds is on their own insured so you can $250,100000. Simultaneously, your trust membership playmorechillipokie.com site there dumps can be insured as much as $250,000 for every recipient, having an optimum number of exposure of $step 1,250,100 for each and every believe holder for each and every financial. To get more info, visit Your Insured Places. Note, whenever an authorized goes wrong (and not the fresh covered financial) FDIC put insurance coverage does not lessen the newest insolvency otherwise personal bankruptcy away from a good nonbank team. If a good nonbank company claims to offer entry to products that they claims is actually FDIC-covered, you will want to select the specific FDIC-insured bank or banking companies where it is said they’re going to deposit the finance.

Switch 2’s Yakuza 0 Director’s Slashed Are An updated Type Lined up During the Old And you can The fresh Fans

Clearly from record, transform to FDIC publicity was somewhat sporadic. In general, throughout the times of high inflation or times of crisis, we could find the fresh FDIC to regulate their publicity when it consider they needed. Merely six months pursuing the production of the brand new FDIC, government leaders know the first $dos,five-hundred limitation wasn’t enough to effectively hold the bank operating system.

Precisely what does Deposit Insurance policy?

For those who’lso are provided opening a cards relationship account, address it the same exact way you might a bank account. Which means evaluating the new costs you can even pay and also the desire you could potentially earn, as well as other provides for example on the internet and cellular banking availableness or the sized its Atm network. Should your financial goes wrong as well as your account balance exceeds the present day FDIC insurance limitation, you may lose the entire number above the limit. Probably be, you’ll sooner or later recover several of you to matter, however, most likely not all of it. For individuals who’lso are not sure if the a certain account type otherwise asset qualifies to have FDIC publicity, pose a question to your financial or standard bank. You’ll usually see the clear answer within the a fine-print disclaimer if you don’t want to communicate with a real time people.

FDIC insurance coverage restrictions and you may control classes

Issues Omitted out of Spend Rates. Which section checklist the brand new increments out of pay that could never be as part of the pay price, as the computed possibly by law or administrative choice. Allow me to share experienced „get off supplements” that are paid to all unlicensed crew players otherwise watch-reputation officers from the Armed forces Sealift Order, to pay to have overtime, penalty otherwise premium spend that is not attained while on subscribed log off. The newest hop out supplement are a means of maintaining salary differentials one of the brand new staff, and that is maybe not one of several kinds of spend excluded by the Point 5 U.S.C. 8114(e).

What’s the FDIC?

It also compares the newest install breadth-damage characteristics to help you characteristics off their portion with the exact same requirements. In the case study, the damage percentage try computed for each group of flooding-impacted assets on the basis of relief payments. The fresh replacement price of the newest impacted components of a creating design and the market price of each and every category of flooding-affected possessions are projected to develop breadth-destroy matchmaking to have building structures. The local depth-destroy setting to have home-based fool around with try compared to the generalized characteristics and you may an online site-certain function establish to your city of Palermo, Italy. Variations and parallels within the wreck datasets is actually examined and you can informed me by associated causative items such as architectural otherwise structural options that come with buildings. Eventually, the use of all of the aforementioned services to help you a 3rd case (the brand new Erasinos lake basin in the Attica, Greece) resulted in a good change (9 %) regarding the estimation of one’s questioned average yearly head problems for residential houses.

Yet not, which number of shelter isn’t the simple. For many who care for higher stability on your bank account, it’s important to know how much of your money is part of the fresh FDIC insurance coverage limitation. If not, some of your own dumps would be on the line if the bank happens belly upwards.

For example, in case your APY is actually 5.25% for the entire year and you may attention are combined everyday, you’ll secure on the $525 within the a year. Explore the checking account calculator observe just how much your is also earn with a high-give savings account. Looking after your offers in the a premier-produce savings account makes a difference in the much time work with. The newest graph less than suggests simply how much you can make in the interest over 5 years holding $ten,100000 inside a classic checking account versus a top-give savings account. You could continue to get the full suits if you remain an excellent $5,000 lowest average each day balance on your own family savings. You’ll discovered an excellent twenty five% match if the equilibrium is lower.

Earn significantly more, Risk Smaller that have Opportunities Financial™ because of the ADM

Put insurance is computed per control category, not for each and every account. Under FDIC legislation, different people’s shared interest in the mutual membership in one organization try covered up to a blended overall out of $250,000. Inside example, your control need for for each membership might possibly be $125,000 since the hobbies of one’s co-owners are thought equivalent. This means the combined interest in all around three joint profile create be $375,000.

Such as, if your mediocre annual income are determined to be $65,100, the fresh claimant’s month-to-month pay rate was centered since the $5,416.67 ($65,000/12). This really is necessary to determine the true days of settlement entitlement. (a) The fresh ECAB provides defined „regular” a job as the „dependent and not make believe, odd-parcel otherwise protected,” evaluating they that have a career created especially for a great claimant. The newest income to own full-time rural carriers may vary along side longevity of the new allege because of re-ratings of the employee’s tasked station. Such transform will change the spend speed to have payment intentions on the go out impairment starts, or if perhaps the fresh employee is doing normal focus on a full-day basis in the course of a reappearance one to qualifies to possess a good perennial shell out speed. If the pay rate to your time disability starts or in the the time of a great qualifying recurrence is leaner compared to the DOI spend rate, then your DOI shell out rate is used in order to compute settlement.